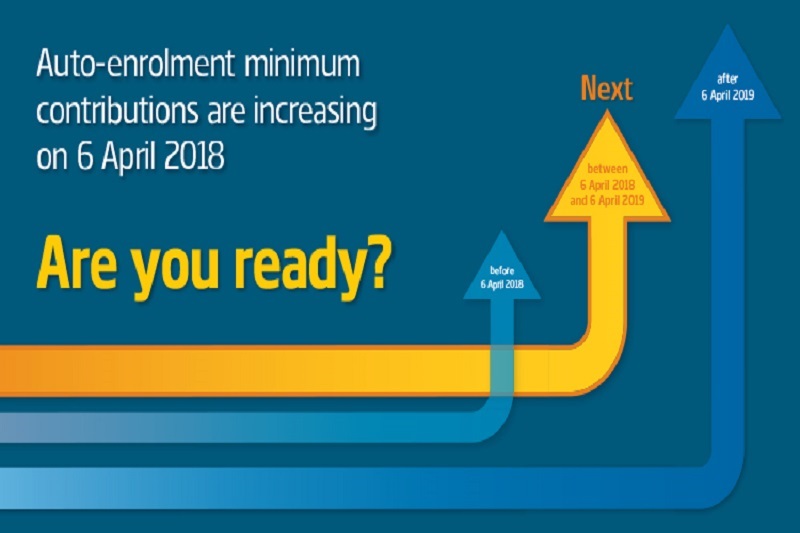

AUTO ENROLMENT PENSION CONTRIBUTIONS INCREASE FROM APRIL

With effect from 6th April, the minimum automatic enrolment (AE) contributions you must pay towards your employees’ pensions will increase. You will now need to contribute at least 2%, whilst the employee is required to contribute 3% themselves through automatic wage deductions. The government has warned that any failure to abide by these new regulations will lead to financial penalties for the organisation in question

STATUTORY PAY RATES TO INCREASE

The weekly pay rates of statutory maternity pay (SMP), statutory adoption pay (SAP), statutory paternity pay (SPP) and shared parental pay (ShPP) will all increase from £140.98 to £145.18.

Coinciding with the new tax year, statutory sick pay (SSP) will increase from 6th April from £89.25 to £92.05 a week. The average weekly earnings limit which an employee must reach to be eligible for these statutory payments will also rise from £113 to £116 a week.

NATIONAL LIVING WAGE AND MINIMUM WAGE INCREASE

You will need to ensure you are paying your employees the new rates.

From the 01st April 2018 the Minimum Wage rates has increased as below:

- 25+ year olds – NMW (National Living Wage) will increase from £7.50 to £7.83 per hour

- 21 – 24 year olds – MW will increase from £7.05 to £7.38 per hour

- 18 – 20 year olds – MW will increase from £5.60 to £5.90 per hour

- 16 – 17 year olds – MW will increase from £4.05 to £4.20 per hour

- Apprentice rate (for apprentices under the age of 19 or 19 and over but in the first year

of apprenticeship) – MW will increase from £3.50 to £3.70 per hour