by siteadmin | Feb 24, 2017 | Book Keeping, PAYE

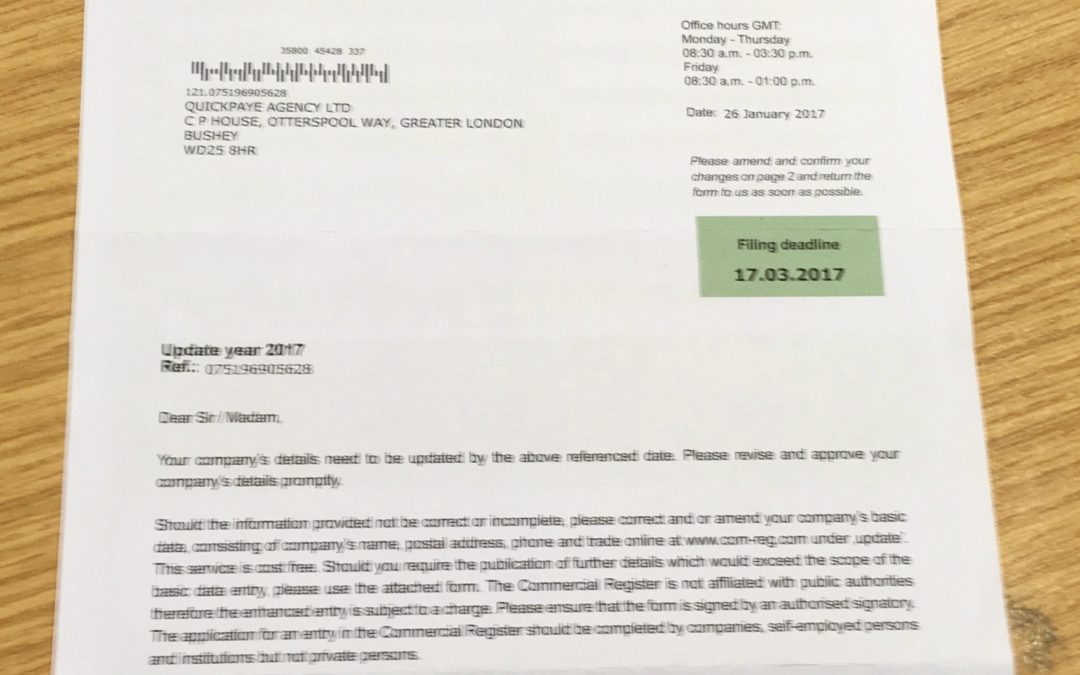

Please look at this letter and take note – it is asking you to update your company details for the COMMERCIAL REGISTER,

PLEASE DO NOT – THIS IS A SCAM

See the article from this link:

http://gloopa.co.uk/commercial-register-scam/

…See more

by siteadmin | Feb 8, 2017 | PAYE, statutory maternity pay, statutory sick pay

Another new tax year is fast approaching, and the new statutory rates are proposed as follows:

- The standard weekly rates of SMP, SAP, SPP and ShPP will increase from £139.58 to £140.98 – it is assumed this will be for payment weeks commencing on or after Sunday, 2 April 2017. The prescribed weekly rate of maternity allowance (MA) will also increase from £139.58 to £140.98.

- The weekly rate of SSP will increase from £88.45 to £89.35 from 6 April 2017.

- The earnings threshold, below which employees are not entitled to SMP, SAP, SPP, ShPP and SSP, will increase from £112 to £113 per week from 6 April 2017.

The rate increases reflect a 1% increase in the consumer price index (CPI) in the year to September 2016.

This will be the first time we have seen an increase since April 2015. This is because, although the rates normally increase each year in line with the CPI, a 0.1% fall in the CPI in the year to September 2015 meant that there were no rate increases in April 2016.

These rates are subject to Parliamentary approval, so changes are possible, but unlikely.

by siteadmin | Jan 13, 2017 | auto enrolment, Book Keeping, PAYE

So thanks to Auto Enrolment, more than 15 million people had signed up to a workplace pension by the end of 2015, and that is 10.6 million more than were enrolled at the start of 2012. This is according to the latest figures released by the Department for Work and Pensions and this is a staggering amount of people.

In plain language, this means that 75 per cent of eligible employees are now enrolled in a workplace pension.

Participation is up across all age and income groups, with the largest increases taking place in the private sector.

Employers need to make sure that their employees are aware of the value of this benefit, as well as the fact that it will be their responsibility to take the decisions to make the most of their pension when the time comes.

Employers can use this to offer incentives to their staff. Instead of an increase in salary, it can be more beneficial to offer to increase the amount of pension paid into the pot, since it will save them tax on the pension contribution.

Auto Enrolment is a key role in retirement planning now for generations to come.

IF YOU ARE HAVING ISSUES WITH AUTO ENROLMENT, THEN CALL US NOW AND WE CAN MAKE THIS HASSLE FREE FOR YOU!

by siteadmin | Dec 19, 2016 | Book Keeping, PAYE

Christmas Parties Allowance

The tax allowance for any annual Parties and functions is £150 per head per year in total. This has been fixed since 2003 and can includes several annual functions such as the Christmas party, summer party or annual golf day.

If a function takes the cost per head over £150, even by just 1p, tax is due on the total cost and not just for the excess over £150.

Some good news is that the employer can plan and choose which event triggers the excess charge, so they pick the lower costing event to treat as fully taxable.

This allowance should go up with inflation, but HMRC has not increased it since 2003. With rising venue costs and employee expectations, pressure is on employers to be able to provide a great party at a reasonable cost.”

Where the costs end up more than £150 per head, employers will be unlikely to want to be seen as mean by asking employees to pay tax on the party.

In this case, they could consider entering into a PAYE Settlement Agreement (PSA), which means that the employer pays the additional tax rather than the employee.

“This tax can increase the cost of the party so the decision should not be taken lightly, but it would be a nice Christmas present for employees.”

by siteadmin | Nov 16, 2016 | PAYE, statutory maternity pay

Because of the struggle involved in balancing business needs and support for working parents, maternity and childcare issues are often in the press.

Proposals to extend statutory maternity pay were recently put forward, from the current 39 weeks to 52 weeks, and to provide 15 hours of free childcare a week for children aged one to four years old.

The idea behind these proposals is to improve incomes and job prospects for working parents, which is often a struggle for employees who are juggling childcare and career progression.

It is not sure whether this will develop into government policy but with a hefty £2 billion price tag, it is certainly a radical idea which will carry pros and cons for both employers and employees.

The positives can be:

- Improved morale for working parents. They should feel more supported by their employer

- Improved reputation for the organisation in its approach to working families. Many job candidates like to see a company demonstrating empathy and support towards its employees

- Less stress for employees planning a family from a financial/career progression perspective. If women know they will receive extended maternity pay, and free childcare, earlier on they will worry less about the financial impact of becoming a parent, and hopefully discard the idea of not returning to work

- Women will be less likely to allow starting a family to affect their career plans

But there also may be negatives:

- Organisations could face workforce planning issues if more women take the full 52 weeks’ maternity leave

- Employees without children could argue they were being disadvantaged because they do not have them

- There may be an increase in pregnancy/maternity discrimination towards those employees benefiting from the increase in statutory maternity pay and free childcare

Out of these, the potential rise in discrimination claims is perhaps the most worrying for an employer as this could be potentially very costly. If this happens then it might be necessary to carry out refresher training on a wide range of equality issues.

Organisations would need to expressly state that all employees should be treated fairly and equally, regardless of their personal life choices, including whether or not to have a family.

Having a checklist to go through with employees before they go off on maternity leave, would be a good idea and should include:

- Confirmation of maternity leave dates

- Clarity on whether the employee will be accessing work emails during leave

- Confirmation from the employee on how she would prefer to be contacted during maternity leave

- Up-to-date phone, email and postal contact details for the employee

- A section that can be signed by the employer and employee to indicate that both parties have agreed to the arrangements