by Michelle Bourne | Apr 27, 2024 | Book Keeping, Payroll

When considering what to write this blog about I wanted to show you the reader how easy it was to simplify your Payroll Process with Quickpaye Agency – ie Why You Should Choose Us?

In any type of business, efficiency and reliability are paramount, especially when it comes to payroll management. At Quickpaye, we understand the challenges that businesses face when it comes to handling payroll, which is why we offer a comprehensive solution designed to simplify and streamline the process.

Here are three reasons from our clients as to why they choose Quickpaye for their payroll needs:

Accessible and Responsive Support:

- One of the frustrations many businesses encounter with other payroll providers is the lack of accessibility and responsiveness when issues arise. At Quickpaye, there is always someone in our team available during office hours to answer your call and assist you with any queries you may have. Our commitment to providing exceptional customer service was recently highlighted when we received praise from a client who stated that we were the only payroll provider who promptly answered the phone. Accessibility to us when you need it, is critical to ensure that you receive the right support, minimising disruptions to your payroll operations and allowing you to focus on other aspects of your business.

Unparalleled Expertise:

- When it comes to payroll management, knowledge is power. That’s why our team at Quickpaye boasts a highly rated combined knowledge base that covers all aspects of payroll processing and compliance. From tax regulations to employee benefits, our team has the experience to provide you with accurate and insightful guidance. Whether you’re a small startup or a large corporation, you can trust that our team will navigate the complexities of payroll with ease, ensuring that your payroll processes are efficient, accurate, and compliant with all relevant regulations.

Friendly and Efficient Service:

- At Quickpaye, we believe that excellent customer service goes beyond just providing solutions—it’s about creating positive experiences for our clients. That’s why we pride ourselves on being friendly and helpful, with all queries answered within a short space of time. We understand that navigating payroll processes can be daunting, which is why we strive to create a supportive environment for our clients. Whether you have a simple question or need assistance with a complex payroll issue, our team provides you with prompt and efficient service, ensuring that your concerns are addressed with care and attention to detail.

By making Quickpaye your trusted partner for all your payroll needs, you will receive accessible and responsive support to our unparalleled expertise and friendly service.

by Michelle Bourne | May 24, 2021 | Book Keeping

Many of us have jobs that are not sexy or glamorous, and Payroll is definitely in the unsexy category but it is also essential.

Therefore most of the time, if your payroll team gets it right, it goes very unnoticed, but when they get it wrong, oh boy do we know it. Receiving the wrong salary payment affects people’s day to day lives, their ability to pay their mortgages and rent are brought into question and payroll are the first people in the line of fire.

That’s why we work hard to ensure we are fully up to date with all the latest Government schemes (let’s face it furlough was a word the UK didn’t really use until last year) HMRC policies, Pension changes and every little element that can cause a possible payroll discrepancy.

So when you use Quickpaye you know that behind every payslip, there sits a person or team who is always in pursuit of knowledge and new legislation whilst battling ever changing software and technology!

The Quickpaye team have worked tirelessly all the way through the pandemic, trying to keep everyone paid accurately and on time and therefore as happy as possible.

So to my team and everyone out there who runs payroll, a big shout out Well Done! We made it through!

Kind regards

Michelle Bourne

Director

by Michelle Bourne | Jun 8, 2020 | Book Keeping

During the Coronavirus epidemic of 2020 the Quickpaye team have been working hard all through Lockdown, getting all payrolls sent out on time, as well as helping our clients claim from HMRC for their Furloughed workers.

Initially we were totally overwhelmed with work, since the Furlough scheme was as new to us as to the rest of the country, after all, before the virus, who in the UK had ever heard of being Furloughed?

Nonetheless, we carried on wading through, the claims were not as easy as one would have hoped, since we also had to be fully authorised by our clients, and of course, not all of them had given us this, but under these new circumstances, they needed this to happen asap! Which was not always easy!

But in true Quickpaye spirit, we soldiered on and thankfully, we are nearly there, having claimed for 100% of our clients who asked for our help.

If you have had a problem with your payroll, or with making a claim for your Furloughed employees, please give us a call, we are here to help you! Having now had the opportunity to work with HMRC on numerous claims we are very well placed to help all businesses.

To make it easier to understand the new rulings, please note the following:

The scheme will close to anyone who hasn’t been furloughed for 3 weeks by 30 June.

Rules will be changing from 1st July

- You will have more flexibility and be able to start bringing back employees to work part time and hours to suit your business

- From 1st August, you will need to contribute towards the wages costs of your Furloughed employees, until the scheme ends on 31 October.

- AUGUST – employers will then have to pay the ER NICS contributions and the pension contributions

- SEPTEMBER – employers will have to pay 10% of the furloughed wages bill plus the ER NICS contributions and the pension contributions

- OCTOBER – employers will have to pay 20% of the furloughed wages bill plus the ER NICS contributions and the pension contributions

Fortunately for SMALL EMPLOYERS, all or some of their Employer NIC bills will be covered by the Employment Allowance so that will significantly help and they will not be so impacted by the new rulings.

Please get in touch if you require any assistance or guidance.

by Michelle Bourne | Oct 4, 2019 | Accounts, Book Keeping, MTD, Payroll, Uncategorized

Which word describes Quickpaye Agency best?

There are some people who like to refer to us as an Accounting agency or even as an Accountancy firm. The truth is that we are a Bookkeeping and Payroll agency. Yet we do a lot of work together with Accounting firms both locally and nationally too. But we are not just a Bookkeeping and Payroll Agency, we do so much more!

How we have helped our clients:

Here at Quickpaye we have helped many people in the past few months to take all the worry and headache out of their Accounts and bookkeeping. Potential clients have come to us in a mess hoping that we can sort them out and so we certainly have! We now have some very happy clients who are delighted that they can now just hand over their Accounting paperwork to us so that we can transform it all into a set of books, which will in turn be converted into a clean and tidy set of Accounts!

If you are currently struggling with your bookwork, or haven’t got a clue about MTD (Making Tax Digital) then please do not hesitate to give us a call.

Because we are the experts and can easily remove this problem from you! You will heave a sigh of relief and wonder why you haven’t done this before!

Call us today on 020 8959 0099, we are waiting to help you!

by Michelle Bourne | Oct 18, 2017 | bereavement pay, Book Keeping, PAYE

New Proposed Laws could give employed parents who lose a child under the age of 18 the right to two weeks’ paid leave which will also be reclaimable by the company.

The Parental Bereavement (Pay and Leave) Bill will give a day-one right to parental bereavement leave and employees with a minimum of 26 weeks’ continuous service will be eligible for statutory parental bereavement pay.

At the moment, there is no legal requirement for employers to provide paid time off for grieving parents, which seems very unfair.

The new law would give parents two weeks’ paid leave and enable businesses to claim back statutory parental bereavement pay.

‘We want parents to feel properly supported by their employer when they go through the deeply distressing ordeal of losing a child,’ said Margot James, Business Minister.

The government is backing this bill since they want parents to be supported by their employer when having to go through this trauma, and therefore it goes significantly further than most other countries in providing this kind of workplace right for employees.

Small employers will be able to recover all statutory parental bereavement pay, while larger employers will be able to reclaim nearly all of it.

The Bill will have its second reading on 20 October, with the ambition of it becoming law in 2020.

by siteadmin | Mar 1, 2017 | Book Keeping, PAYE, Uncategorized

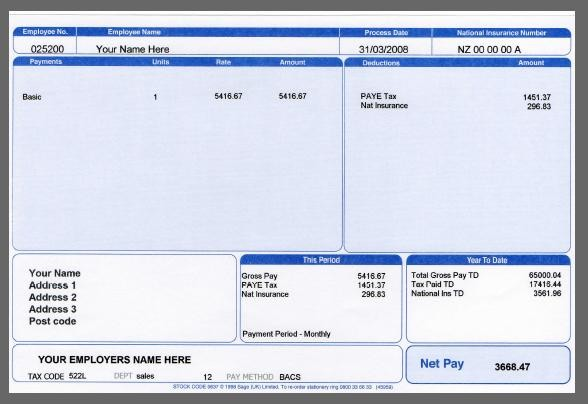

OUTSOURCING YOUR PAYROLL

Even the most experienced professionals find that payroll can be a real headache. Slap onto this a heavy penalty for a filing omission, and now we’re talking a full-blown financially-induced migraine!

For many businesses, outsourcing your payroll can offer an attractive and valuable alternative to in-house processing.

If chosen correctly, they provide a host of duties which will take your headache away!

However, choosing poorly can make it a hassle to leave, and frustration to stay, so it is essential to find the right provider for you.

In truth, smaller firms with a stable, salaried staff and minimal changes may well be better off processing internally, but ultimately many companies discover it’s not really that cheap — especially when you factor in the time spent managing the process, and also, without the proper knowledge or training of payroll legislation it’s easy to make mistakes.

Finally, using a payroll provider can ease your mind. The Internal Revenue Service has reported that one out of every three employers has been charged for a payroll mistake.

When to outsource

Using a payroll service makes sense if your payroll changes with every pay period. If your company has employees working varied hours per week or has a significant turnover then a payroll service can be time-saving and cost-effective.

Choosing a provider

- As well as offering the services you require, a payroll service should offer a high level of customer service. Unlike some other business services, you will need to communicate regularly with your payroll provider.

- Request references from current clients to gain a better sense of the provider’s level of customer service and read all testimonials to them that you can find.

- Avoid multiple unnecessary charges by knowing which service features you are most interested in before choosing a payroll company. In general, look out for providers that offer low base processing rates with expensive add-on features.

Questions to ask:

Features

- What does your basic service include?

- How quickly can you re-run a payroll if there is a mistake?

- How long does the average client stay with you?

Look for a stable provider

If a firm’s only business is payroll, make sure to check the number of clients it supports. To ensure stability, a payroll service should ideally maintain at least one hundred clients.

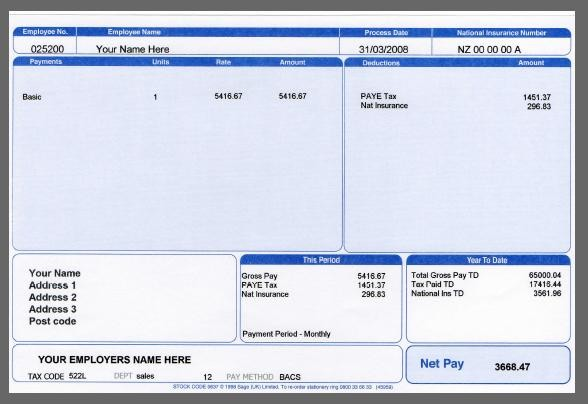

Double-check the math when switching

Be especially thorough in reviewing the first payslips issued through the service for the first pay period.

NOW HAVE A LOOK AT QUICKPAYE’S TESTIMONIALS AND CALL US FOR A FREE CONSULTATION – OUR SERVICE CAN TRANSFORM YOUR WORKLOAD AND TAKE THAT HEADACHE AWAY!