OUTSOURCING YOUR PAYROLL

Even the most experienced professionals find that payroll can be a real headache. Slap onto this a heavy penalty for a filing omission, and now we’re talking a full-blown financially-induced migraine!

For many businesses, outsourcing your payroll can offer an attractive and valuable alternative to in-house processing.

If chosen correctly, they provide a host of duties which will take your headache away!

However, choosing poorly can make it a hassle to leave, and frustration to stay, so it is essential to find the right provider for you.

In truth, smaller firms with a stable, salaried staff and minimal changes may well be better off processing internally, but ultimately many companies discover it’s not really that cheap — especially when you factor in the time spent managing the process, and also, without the proper knowledge or training of payroll legislation it’s easy to make mistakes.

Finally, using a payroll provider can ease your mind. The Internal Revenue Service has reported that one out of every three employers has been charged for a payroll mistake.

When to outsource

Using a payroll service makes sense if your payroll changes with every pay period. If your company has employees working varied hours per week or has a significant turnover then a payroll service can be time-saving and cost-effective.

Choosing a provider

- As well as offering the services you require, a payroll service should offer a high level of customer service. Unlike some other business services, you will need to communicate regularly with your payroll provider.

- Request references from current clients to gain a better sense of the provider’s level of customer service and read all testimonials to them that you can find.

- Avoid multiple unnecessary charges by knowing which service features you are most interested in before choosing a payroll company. In general, look out for providers that offer low base processing rates with expensive add-on features.

Questions to ask:

Features

- What does your basic service include?

- How quickly can you re-run a payroll if there is a mistake?

- How long does the average client stay with you?

Look for a stable provider

If a firm’s only business is payroll, make sure to check the number of clients it supports. To ensure stability, a payroll service should ideally maintain at least one hundred clients.

Double-check the math when switching

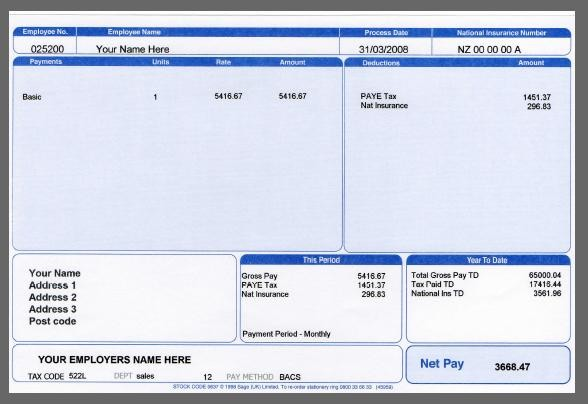

Be especially thorough in reviewing the first payslips issued through the service for the first pay period.

NOW HAVE A LOOK AT QUICKPAYE’S TESTIMONIALS AND CALL US FOR A FREE CONSULTATION – OUR SERVICE CAN TRANSFORM YOUR WORKLOAD AND TAKE THAT HEADACHE AWAY!