by siteadmin | Nov 14, 2024 | Payroll, statutory maternity pay, statutory sick pay

It’s that time of year again when some of us need to submit a Self-Assessment Tax Return if you have income outside of your PAYE earnings.

Who has to do a UK tax return in January?

You may need to submit a self-assessment tax return in the UK if you:

- Are self-employed

- Have income from renting out property

- Receive income from investments, dividends, or savings interest above your personal allowance

- Are a company director

- Have income of £100,000 or more

- Receive income from abroad that you need to pay tax on

- Receive child benefit and your or your partner’s income is over £50,000

- Have made capital gains above the annual exemption

The deadline for submitting a self-assessment tax return is usually 31st January following the end of the tax year (6th April to 5th April). However, the specific requirements and deadlines can vary, so it’s best to check your personal situation.

Are you being overcharged for your Tax Return?

Your trusted and efficient team at Quickpaye can process your return for you from £225 +vat (for a basic return). We offer this service to all our valued clients, old and new and for the rest of November if you book Quickpaye to complete your self assessment tax return for you, and then recommend us to someone else, you will receive an Amazon voucher for £35 just in time for Christmas.

Call Quickpaye Agency on 01923 650208 to sort your Self Employed Tax returns.

by Michelle Bourne | May 2, 2024 | Payroll, statutory maternity pay, statutory sick pay

At Quickpaye, we’re committed to keeping our clients informed about important changes that may impact their payroll operations. As we approach the new tax year, it’s crucial to be aware of updates to statutory payments, which can affect both employers and employees.

Here’s what you need to know about the recent changes:

Standard Rate Increase for Statutory Maternity, Paternity, Adoption, and Shared Parental Payments:

Effective from April 6th, 2024, the standard rate for Statutory Maternity Pay (SMP), Statutory Paternity Pay (SPP), Statutory Adoption Pay (SAP), and Statutory Shared Parental Pay (ShPP) has increased from £172.48 per week to £184.03 per week. This adjustment aims to provide greater support to employees during periods of leave related to childbirth, adoption, and childcare responsibilities.

What This Means for Employers:

- Employers should ensure that payroll systems are updated to reflect the new standard rate for statutory payments.

- When processing payroll for employees on maternity, paternity, adoption, or shared parental leave, employers should use the revised rate to calculate their entitlements accurately.

- It’s essential to communicate these changes to affected employees to avoid any confusion or discrepancies in their payments.

Statutory Sick Pay (SSP) Changes:

Additionally, Statutory Sick Pay (SSP) will see an increase from £109.40 per week to £116.75 per week, effective from April 6th, 2024. This adjustment aims to provide better support to employees who are unable to work due to illness or injury, ensuring that they receive adequate compensation during their absence from work.

If you are not yet working with us then this is how Quickpaye could help you:

At Quickpaye, we understand the importance of staying compliant with statutory payment regulations while ensuring accuracy and efficiency in payroll processing. Our comprehensive payroll solutions are designed to accommodate changes in statutory payments seamlessly, allowing employers to navigate these updates with ease.

- Our advanced payroll team automatically update statutory payment rates, ensuring that calculations are accurate and compliant with HMRC regulations.

- Our team of payroll experts is available to provide guidance and support, assisting you in understanding the implications of statutory payment changes.

- With Quickpaye by your side, you can rest assured that your payroll operations remain compliant, efficient, and hassle-free, allowing you to focus on running your business effectively.

As statutory payment rates increase, it’s essential for employers to stay informed and ensure compliance with updated regulations. With support from Quickpaye, clients can navigate these changes seamlessly, ensuring that their payroll operations remain accurate, compliant, and efficient. Stay tuned for more updates and guidance from Quickpaye as we continue to support your payroll needs.

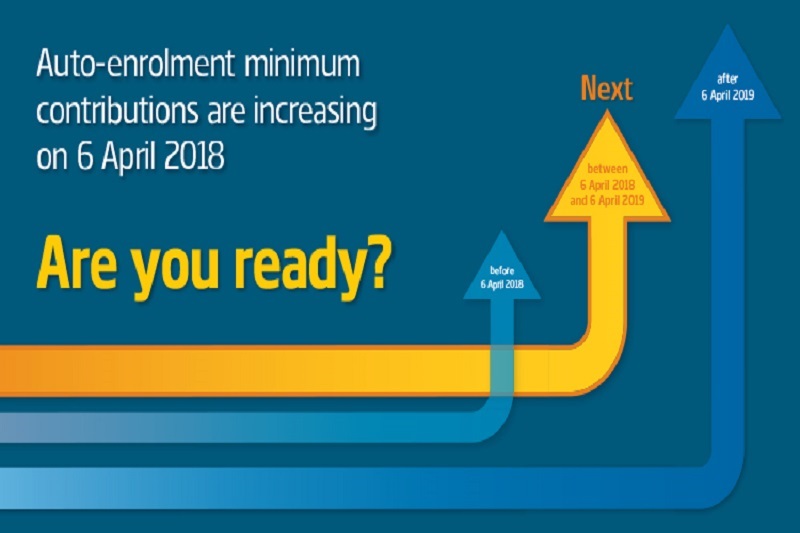

by Michelle Bourne | Apr 17, 2018 | auto enrolment, national insurance, National Minimum Wage, PAYE, statutory maternity pay, statutory sick pay

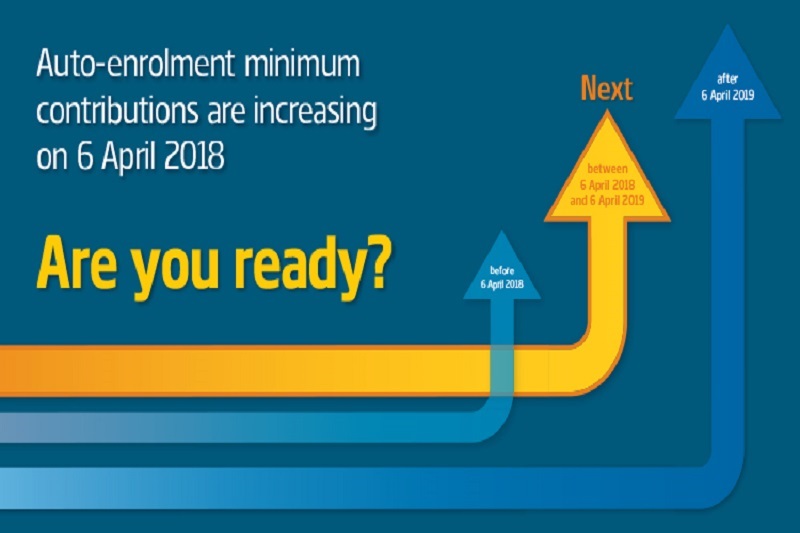

AUTO ENROLMENT PENSION CONTRIBUTIONS INCREASE FROM APRIL

With effect from 6th April, the minimum automatic enrolment (AE) contributions you must pay towards your employees’ pensions will increase. You will now need to contribute at least 2%, whilst the employee is required to contribute 3% themselves through automatic wage deductions. The government has warned that any failure to abide by these new regulations will lead to financial penalties for the organisation in question

STATUTORY PAY RATES TO INCREASE

The weekly pay rates of statutory maternity pay (SMP), statutory adoption pay (SAP), statutory paternity pay (SPP) and shared parental pay (ShPP) will all increase from £140.98 to £145.18.

Coinciding with the new tax year, statutory sick pay (SSP) will increase from 6th April from £89.25 to £92.05 a week. The average weekly earnings limit which an employee must reach to be eligible for these statutory payments will also rise from £113 to £116 a week.

NATIONAL LIVING WAGE AND MINIMUM WAGE INCREASE

You will need to ensure you are paying your employees the new rates.

From the 01st April 2018 the Minimum Wage rates has increased as below:

- 25+ year olds – NMW (National Living Wage) will increase from £7.50 to £7.83 per hour

- 21 – 24 year olds – MW will increase from £7.05 to £7.38 per hour

- 18 – 20 year olds – MW will increase from £5.60 to £5.90 per hour

- 16 – 17 year olds – MW will increase from £4.05 to £4.20 per hour

- Apprentice rate (for apprentices under the age of 19 or 19 and over but in the first year

of apprenticeship) – MW will increase from £3.50 to £3.70 per hour

by siteadmin | Feb 8, 2017 | PAYE, statutory maternity pay, statutory sick pay

Another new tax year is fast approaching, and the new statutory rates are proposed as follows:

- The standard weekly rates of SMP, SAP, SPP and ShPP will increase from £139.58 to £140.98 – it is assumed this will be for payment weeks commencing on or after Sunday, 2 April 2017. The prescribed weekly rate of maternity allowance (MA) will also increase from £139.58 to £140.98.

- The weekly rate of SSP will increase from £88.45 to £89.35 from 6 April 2017.

- The earnings threshold, below which employees are not entitled to SMP, SAP, SPP, ShPP and SSP, will increase from £112 to £113 per week from 6 April 2017.

The rate increases reflect a 1% increase in the consumer price index (CPI) in the year to September 2016.

This will be the first time we have seen an increase since April 2015. This is because, although the rates normally increase each year in line with the CPI, a 0.1% fall in the CPI in the year to September 2015 meant that there were no rate increases in April 2016.

These rates are subject to Parliamentary approval, so changes are possible, but unlikely.