by siteadmin | Nov 14, 2024 | Payroll, statutory maternity pay, statutory sick pay

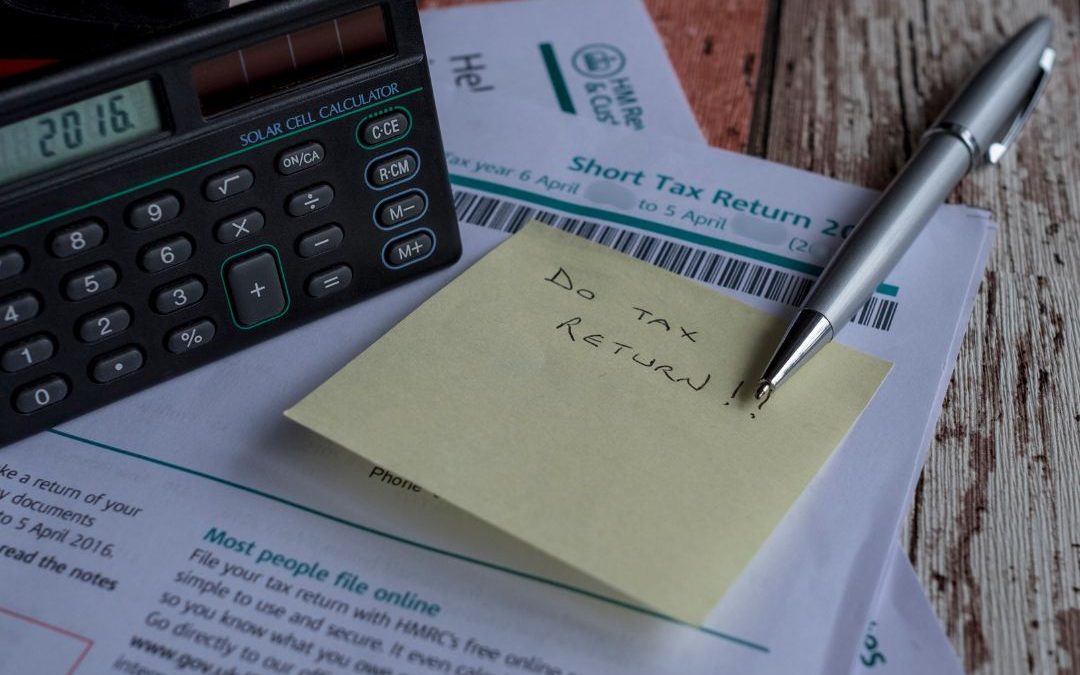

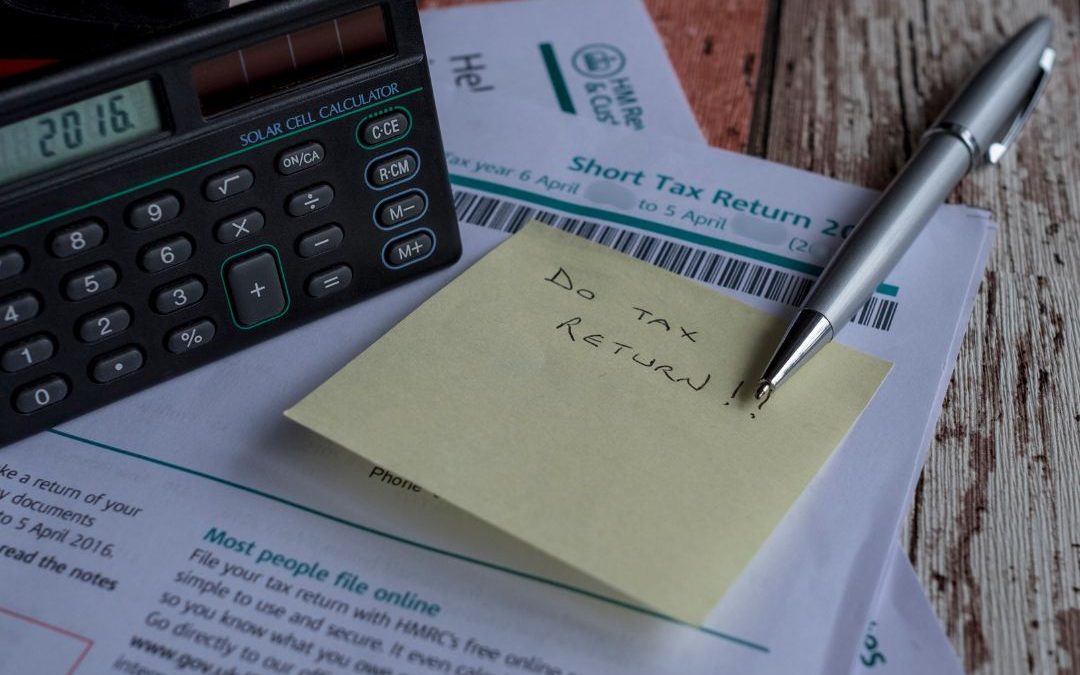

It’s that time of year again when some of us need to submit a Self-Assessment Tax Return if you have income outside of your PAYE earnings.

Who has to do a UK tax return in January?

You may need to submit a self-assessment tax return in the UK if you:

- Are self-employed

- Have income from renting out property

- Receive income from investments, dividends, or savings interest above your personal allowance

- Are a company director

- Have income of £100,000 or more

- Receive income from abroad that you need to pay tax on

- Receive child benefit and your or your partner’s income is over £50,000

- Have made capital gains above the annual exemption

The deadline for submitting a self-assessment tax return is usually 31st January following the end of the tax year (6th April to 5th April). However, the specific requirements and deadlines can vary, so it’s best to check your personal situation.

Are you being overcharged for your Tax Return?

Your trusted and efficient team at Quickpaye can process your return for you from £225 +vat (for a basic return). We offer this service to all our valued clients, old and new and for the rest of November if you book Quickpaye to complete your self assessment tax return for you, and then recommend us to someone else, you will receive an Amazon voucher for £35 just in time for Christmas.

Call Quickpaye Agency on 01923 650208 to sort your Self Employed Tax returns.

by siteadmin | May 2, 2017 | auto enrolment, PAYE

DID YOU KNOW THAT 4TH MAY IS INTERNATIONAL PAYROLL DAY???

LET’S PUT PAYROLL ON THE MAP!

This historic occasion is being held to bring together the global and in country payroll community to honour all of our achievements around the world.

We can reflect our growing strategic importance to the business.

Here at Quickpaye we are marking this event with a SPECIAL OFFER!

FREE SET UP FOR THE MONTH OF MAY if you want us to run your payroll for you! THIS IS WORTH £60 + !!!

We pride ourselves on being better than the people next door, we are always here to answer all queries and provide help with especially AUTO ENROLMENT which is a tough subject for all!

by siteadmin | Mar 15, 2017 | auto enrolment, PAYE

If you persistently ignore the penalty notices from the Pensions Regulator, then you risk receiving a COUNTY COURT JUDGEMENT for a failure to pay!

We are starting to see the first employers getting a CCJ, which can risk the future of your business!

Contact the Pensions Regulator before this happens to you. They can help you to avoid serious consequences.

Employers within the food and drink sector have recently been issued with a large proportion of penalty notices. In this sector there are typically employed a large number of temporary workers, with many people employed without a contract.

If you are worried about this happening to you then just call us at Quickpaye for our expert help and advice. We can make this headache dissolve away!

by siteadmin | Mar 8, 2017 | PAYE

The National Living Wage and the Minimum Wage will be increasing on the 1st April 2017.

As from April 2017 both the MW and NLW will increase each year in April instead of October, going forward.

You will need to prepare for the changes and ensure you are paying your employees the new rates.

From the 1st April 2017 the Minimum Wage rates will increase as below:

- 25+ year olds – NMW (National Living Wage) will increase from £7.20 to £7.50 per hour

- 21 – 24 year olds – MW will increase from £6.95 to £7.05 per hour

- 18 – 20 year olds – MW will increase from £5.55 to £5.60 per hour

- 16 – 17 year olds – MW will increase from £4.00 to £4.05 per hour

- Apprentice rate (for apprentices under the age of 19 or 19 and over but in the first year

of apprenticeship) – MW will increase from £3.40 to £3.50 per hour

N.B. Don’t forget that failure to pay the correct rate could lead to a penalty charge of up to £20,000 for each member of staff underpaid.

by siteadmin | Mar 1, 2017 | Book Keeping, PAYE, Uncategorized

OUTSOURCING YOUR PAYROLL

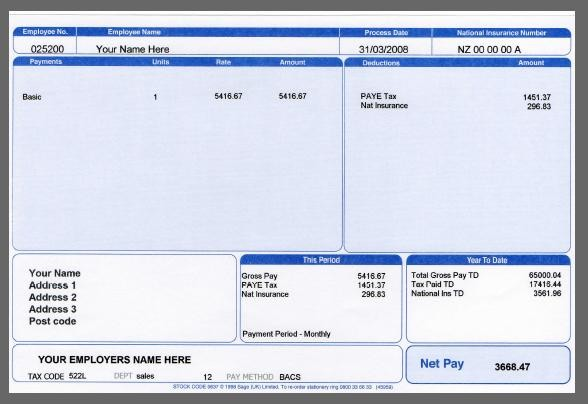

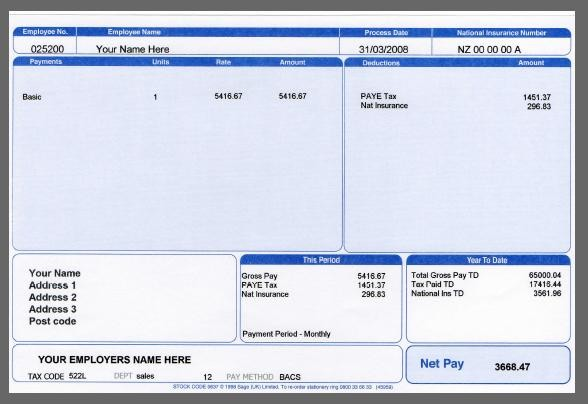

Even the most experienced professionals find that payroll can be a real headache. Slap onto this a heavy penalty for a filing omission, and now we’re talking a full-blown financially-induced migraine!

For many businesses, outsourcing your payroll can offer an attractive and valuable alternative to in-house processing.

If chosen correctly, they provide a host of duties which will take your headache away!

However, choosing poorly can make it a hassle to leave, and frustration to stay, so it is essential to find the right provider for you.

In truth, smaller firms with a stable, salaried staff and minimal changes may well be better off processing internally, but ultimately many companies discover it’s not really that cheap — especially when you factor in the time spent managing the process, and also, without the proper knowledge or training of payroll legislation it’s easy to make mistakes.

Finally, using a payroll provider can ease your mind. The Internal Revenue Service has reported that one out of every three employers has been charged for a payroll mistake.

When to outsource

Using a payroll service makes sense if your payroll changes with every pay period. If your company has employees working varied hours per week or has a significant turnover then a payroll service can be time-saving and cost-effective.

Choosing a provider

- As well as offering the services you require, a payroll service should offer a high level of customer service. Unlike some other business services, you will need to communicate regularly with your payroll provider.

- Request references from current clients to gain a better sense of the provider’s level of customer service and read all testimonials to them that you can find.

- Avoid multiple unnecessary charges by knowing which service features you are most interested in before choosing a payroll company. In general, look out for providers that offer low base processing rates with expensive add-on features.

Questions to ask:

Features

- What does your basic service include?

- How quickly can you re-run a payroll if there is a mistake?

- How long does the average client stay with you?

Look for a stable provider

If a firm’s only business is payroll, make sure to check the number of clients it supports. To ensure stability, a payroll service should ideally maintain at least one hundred clients.

Double-check the math when switching

Be especially thorough in reviewing the first payslips issued through the service for the first pay period.

NOW HAVE A LOOK AT QUICKPAYE’S TESTIMONIALS AND CALL US FOR A FREE CONSULTATION – OUR SERVICE CAN TRANSFORM YOUR WORKLOAD AND TAKE THAT HEADACHE AWAY!