by siteadmin | Mar 8, 2017 | PAYE

The National Living Wage and the Minimum Wage will be increasing on the 1st April 2017.

As from April 2017 both the MW and NLW will increase each year in April instead of October, going forward.

You will need to prepare for the changes and ensure you are paying your employees the new rates.

From the 1st April 2017 the Minimum Wage rates will increase as below:

- 25+ year olds – NMW (National Living Wage) will increase from £7.20 to £7.50 per hour

- 21 – 24 year olds – MW will increase from £6.95 to £7.05 per hour

- 18 – 20 year olds – MW will increase from £5.55 to £5.60 per hour

- 16 – 17 year olds – MW will increase from £4.00 to £4.05 per hour

- Apprentice rate (for apprentices under the age of 19 or 19 and over but in the first year

of apprenticeship) – MW will increase from £3.40 to £3.50 per hour

N.B. Don’t forget that failure to pay the correct rate could lead to a penalty charge of up to £20,000 for each member of staff underpaid.

by siteadmin | Mar 1, 2017 | Book Keeping, PAYE, Uncategorized

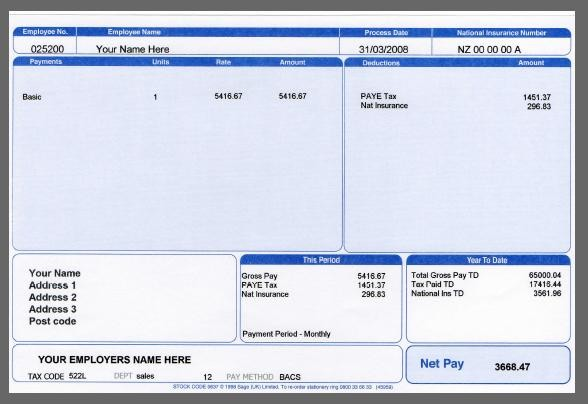

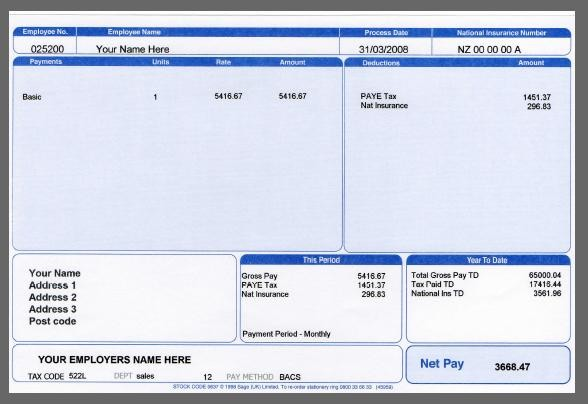

OUTSOURCING YOUR PAYROLL

Even the most experienced professionals find that payroll can be a real headache. Slap onto this a heavy penalty for a filing omission, and now we’re talking a full-blown financially-induced migraine!

For many businesses, outsourcing your payroll can offer an attractive and valuable alternative to in-house processing.

If chosen correctly, they provide a host of duties which will take your headache away!

However, choosing poorly can make it a hassle to leave, and frustration to stay, so it is essential to find the right provider for you.

In truth, smaller firms with a stable, salaried staff and minimal changes may well be better off processing internally, but ultimately many companies discover it’s not really that cheap — especially when you factor in the time spent managing the process, and also, without the proper knowledge or training of payroll legislation it’s easy to make mistakes.

Finally, using a payroll provider can ease your mind. The Internal Revenue Service has reported that one out of every three employers has been charged for a payroll mistake.

When to outsource

Using a payroll service makes sense if your payroll changes with every pay period. If your company has employees working varied hours per week or has a significant turnover then a payroll service can be time-saving and cost-effective.

Choosing a provider

- As well as offering the services you require, a payroll service should offer a high level of customer service. Unlike some other business services, you will need to communicate regularly with your payroll provider.

- Request references from current clients to gain a better sense of the provider’s level of customer service and read all testimonials to them that you can find.

- Avoid multiple unnecessary charges by knowing which service features you are most interested in before choosing a payroll company. In general, look out for providers that offer low base processing rates with expensive add-on features.

Questions to ask:

Features

- What does your basic service include?

- How quickly can you re-run a payroll if there is a mistake?

- How long does the average client stay with you?

Look for a stable provider

If a firm’s only business is payroll, make sure to check the number of clients it supports. To ensure stability, a payroll service should ideally maintain at least one hundred clients.

Double-check the math when switching

Be especially thorough in reviewing the first payslips issued through the service for the first pay period.

NOW HAVE A LOOK AT QUICKPAYE’S TESTIMONIALS AND CALL US FOR A FREE CONSULTATION – OUR SERVICE CAN TRANSFORM YOUR WORKLOAD AND TAKE THAT HEADACHE AWAY!

by siteadmin | Feb 24, 2017 | Book Keeping, PAYE

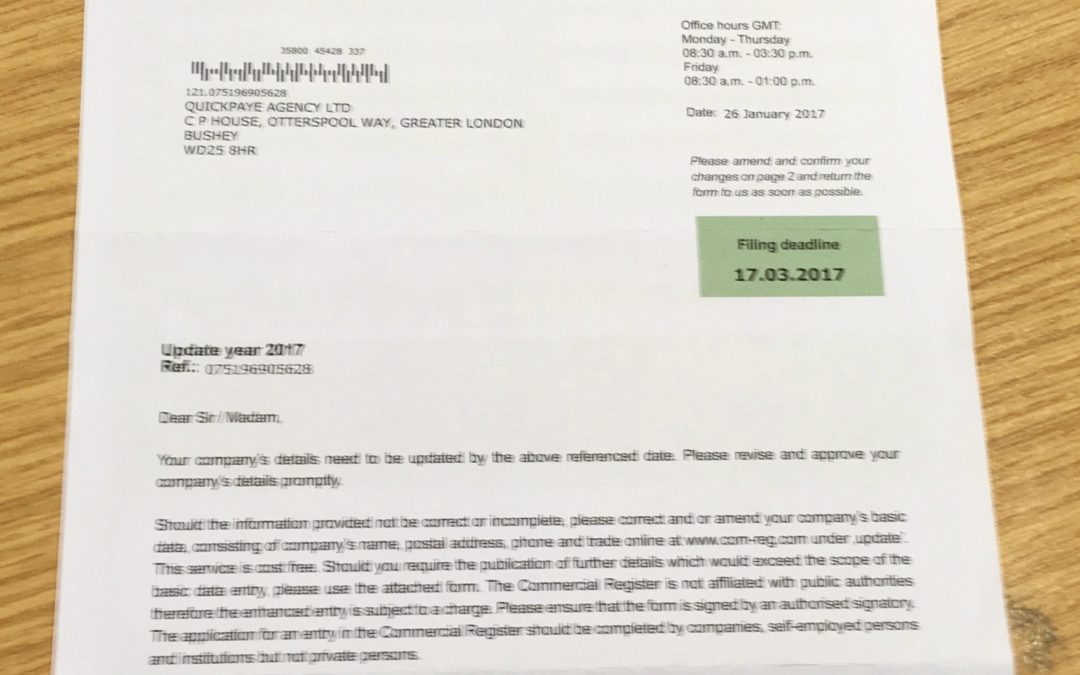

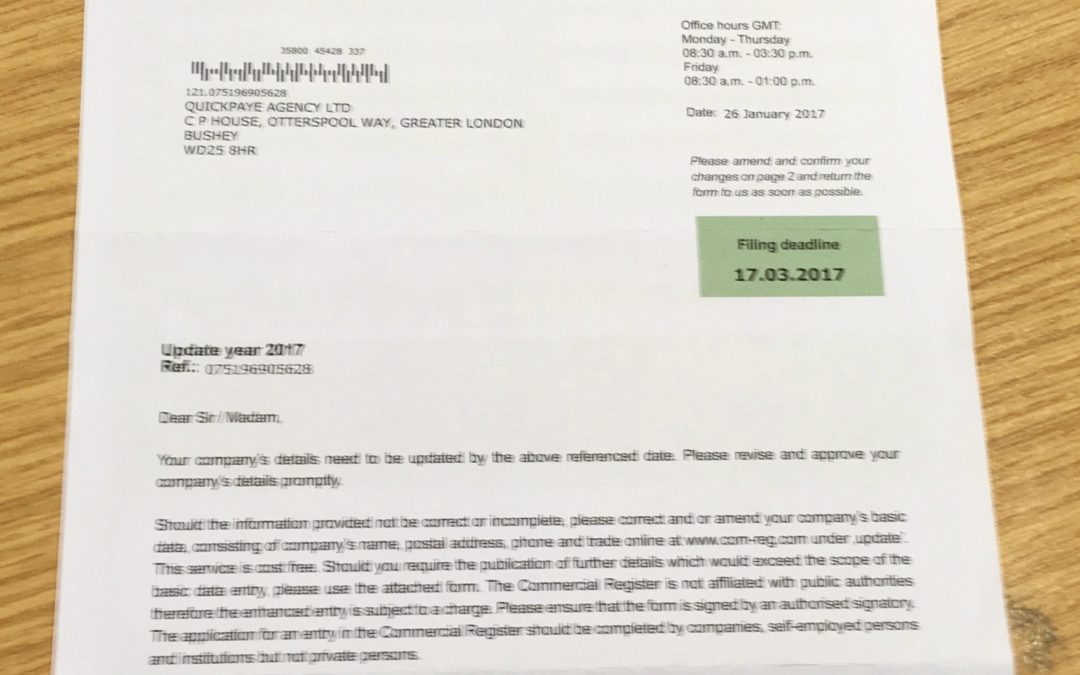

Please look at this letter and take note – it is asking you to update your company details for the COMMERCIAL REGISTER,

PLEASE DO NOT – THIS IS A SCAM

See the article from this link:

http://gloopa.co.uk/commercial-register-scam/

…See more

by siteadmin | Feb 8, 2017 | PAYE, statutory maternity pay, statutory sick pay

Another new tax year is fast approaching, and the new statutory rates are proposed as follows:

- The standard weekly rates of SMP, SAP, SPP and ShPP will increase from £139.58 to £140.98 – it is assumed this will be for payment weeks commencing on or after Sunday, 2 April 2017. The prescribed weekly rate of maternity allowance (MA) will also increase from £139.58 to £140.98.

- The weekly rate of SSP will increase from £88.45 to £89.35 from 6 April 2017.

- The earnings threshold, below which employees are not entitled to SMP, SAP, SPP, ShPP and SSP, will increase from £112 to £113 per week from 6 April 2017.

The rate increases reflect a 1% increase in the consumer price index (CPI) in the year to September 2016.

This will be the first time we have seen an increase since April 2015. This is because, although the rates normally increase each year in line with the CPI, a 0.1% fall in the CPI in the year to September 2015 meant that there were no rate increases in April 2016.

These rates are subject to Parliamentary approval, so changes are possible, but unlikely.

by siteadmin | Jan 13, 2017 | auto enrolment, Book Keeping, PAYE

So thanks to Auto Enrolment, more than 15 million people had signed up to a workplace pension by the end of 2015, and that is 10.6 million more than were enrolled at the start of 2012. This is according to the latest figures released by the Department for Work and Pensions and this is a staggering amount of people.

In plain language, this means that 75 per cent of eligible employees are now enrolled in a workplace pension.

Participation is up across all age and income groups, with the largest increases taking place in the private sector.

Employers need to make sure that their employees are aware of the value of this benefit, as well as the fact that it will be their responsibility to take the decisions to make the most of their pension when the time comes.

Employers can use this to offer incentives to their staff. Instead of an increase in salary, it can be more beneficial to offer to increase the amount of pension paid into the pot, since it will save them tax on the pension contribution.

Auto Enrolment is a key role in retirement planning now for generations to come.

IF YOU ARE HAVING ISSUES WITH AUTO ENROLMENT, THEN CALL US NOW AND WE CAN MAKE THIS HASSLE FREE FOR YOU!

by siteadmin | Dec 19, 2016 | Book Keeping, PAYE

Christmas Parties Allowance

The tax allowance for any annual Parties and functions is £150 per head per year in total. This has been fixed since 2003 and can includes several annual functions such as the Christmas party, summer party or annual golf day.

If a function takes the cost per head over £150, even by just 1p, tax is due on the total cost and not just for the excess over £150.

Some good news is that the employer can plan and choose which event triggers the excess charge, so they pick the lower costing event to treat as fully taxable.

This allowance should go up with inflation, but HMRC has not increased it since 2003. With rising venue costs and employee expectations, pressure is on employers to be able to provide a great party at a reasonable cost.”

Where the costs end up more than £150 per head, employers will be unlikely to want to be seen as mean by asking employees to pay tax on the party.

In this case, they could consider entering into a PAYE Settlement Agreement (PSA), which means that the employer pays the additional tax rather than the employee.

“This tax can increase the cost of the party so the decision should not be taken lightly, but it would be a nice Christmas present for employees.”